BTCUSDT remains one of the most actively traded cryptocurrency pairs globally. Its volatility and liquidity attract traders seeking quick profits, but the market also exposes participants to substantial risks. Successful trading requires strategy, discipline, and awareness of common pitfalls that can erode gains. Understanding these mistakes can save both time and capital, particularly when trading BTCUSDT, where liquidity and advanced tools provide opportunities but demand responsibility. This guide explores frequent errors and offers strategies to improve trading outcomes for beginners and intermediates alike.

Ignoring Market Trends and Technical Analysis

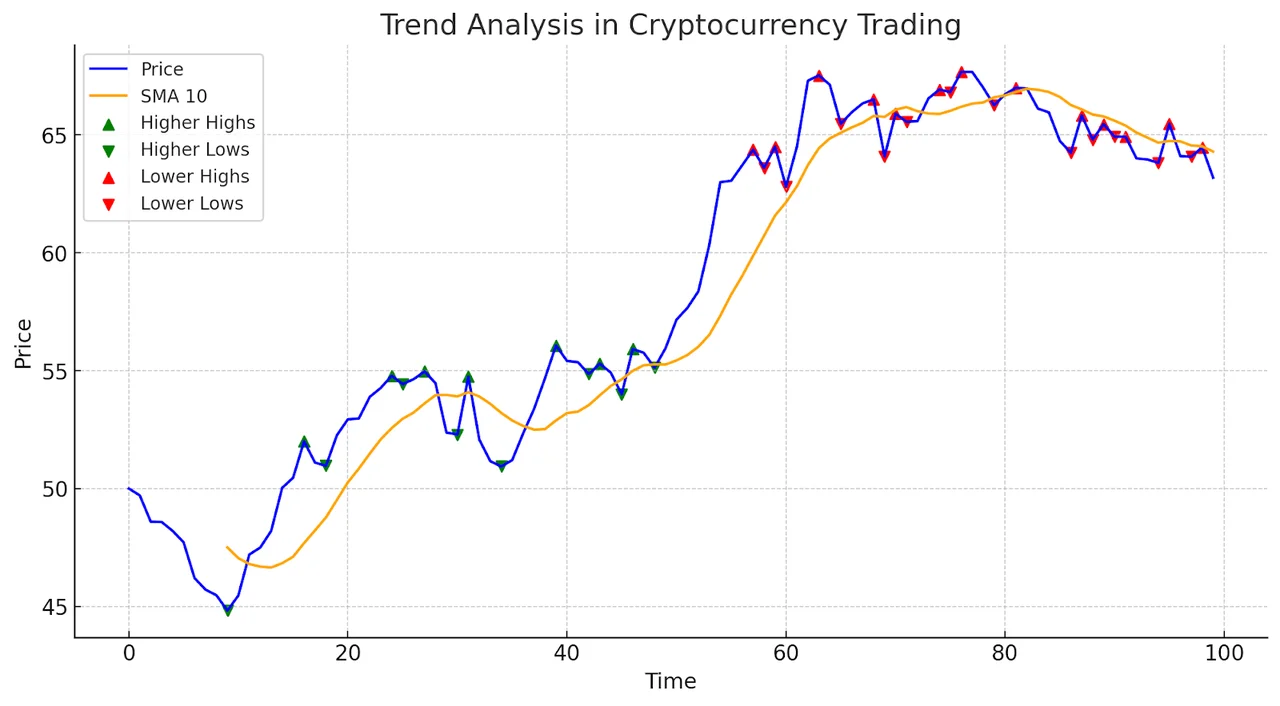

Many traders allow emotions to guide decisions instead of following objective market signals. This approach often leads to entering positions against the prevailing trend or exiting prematurely. In BTCUSDT trading, recognizing market trends is critical because price movements follow identifiable patterns influenced by supply, demand, and investor sentiment. Ignoring technical analysis increases the risk of entering at high points and selling at low points. Consistently analyzing charts and respecting trend directions ensures better entry and exit decisions, reducing unnecessary losses.

Key Technical Indicators to Monitor

Several technical indicators help identify trends and momentum. Moving averages smooth price data and indicate the overall direction. The Relative Strength Index (RSI) signals overbought or oversold conditions, helping avoid entries during extreme swings. MACD (Moving Average Convergence Divergence) tracks trend strength and potential reversals. Support and resistance levels mark critical price zones where the market often reacts. According to a 2023 study by CFA Institute, traders using combined indicators improved timing accuracy by over 30%. Regular monitoring ensures decisions are rooted in objective data rather than impulse. You can take advantage of efficient execution and advanced charting features when trading BTCUSDT on Zoomex, maximizing your trading potential.

Overleveraging and Mismanaging Risk

Leverage amplifies both profits and losses in BTCUSDT contracts, making risk management essential. A common mistake is opening positions too large relative to the account balance, which can lead to liquidation during normal market fluctuations. Overconfidence or greed often drives traders to take unnecessary risks, exposing capital to extreme swings that could have been avoided with careful planning. Understanding leverage and implementing safety measures is crucial for maintaining a sustainable trading approach.

Risk Management Best Practices

Setting stop-loss and take-profit levels protects funds from unexpected market movements. Avoid risking more than 1-2 percent of total account balance on a single trade to minimize drawdowns. Proper position sizing ensures losses do not overwhelm gains over time. Traders also need to be aware of psychological traps that lead to overleveraging, such as chasing missed opportunities or trying to recover losses too quickly. A disciplined approach safeguards both account longevity and mental stability.

Trading Without a Clear Strategy

Impulsive trading often erodes long-term profitability. Many enter trades based on rumors, hype, or sudden market spikes, ignoring broader context. Without a structured approach, repeated losses can accumulate quickly, reducing capital and confidence. Establishing a defined strategy is essential to staying consistent and disciplined amidst the market’s volatility.

Components of a Trading Strategy

A comprehensive strategy includes defined entry and exit rules. Assessing risk-reward ratios before placing trades ensures potential gains justify exposure. Backup plans for sudden market volatility prevent hasty reactions that harm accounts.

Common Strategy Mistakes

- Trading solely based on tips or social media signals.

- Entering trades without analyzing the market context

- Ignoring the impact of trading fees on profitability

Developing a structured strategy and avoiding these errors improves overall trading performance and decision-making.

Ignoring Market Volatility and News Events

BTCUSDT is highly volatile, with prices often swinging rapidly within hours. Global news, regulatory announcements, and macroeconomic events can trigger sharp market reactions. Traders who overlook these factors may face unexpected losses. Staying aware of market-moving events allows for more informed trading decisions and avoids exposure to sudden price shocks.

How to Mitigate Volatility Risks

Following real-time news feeds keeps traders updated on relevant developments. Avoid holding highly leveraged positions during high-impact events to prevent liquidation. Using limit orders instead of market orders during uncertain periods helps control entry prices and reduce slippage. Awareness of external factors combined with disciplined trading can significantly reduce the negative impact of volatility.

Overtrading and Emotional Decision-Making

Overtrading occurs when positions are opened excessively without a clear plan, often driven by emotions. Fear of missing out (FOMO) or panic-selling during market swings can rapidly erode profits and confidence. Emotional decision-making compromises rational analysis, making it harder to recover from mistakes.

Practical Methods to Control Emotions

Maintaining a trading journal documents decisions, allowing reflection on patterns of error. Setting daily or weekly trade limits helps prevent impulsive activity. Taking regular breaks avoids fatigue-driven mistakes. By applying these methods, traders can maintain focus, reduce errors, and build a more disciplined approach to BTCUSDT trading.

Neglecting Security and Platform Reliability

Security and platform reliability are fundamental for safe trading. Using insecure exchanges exposes funds to hacks, scams, and operational failures. Carefully evaluating platforms prevents losses due to technological or procedural vulnerabilities. Traders should prioritize exchanges that protect both digital assets and trading functionality.

| Feature | Importance | Impact on BTCUSDT Trading |

| Two-Factor Authentication | High | Prevents unauthorized access |

| Cold Storage | High | Protects funds from online attacks |

| Low Latency Trading Interface | Medium | Reduces slippage in fast markets |

| Regulatory Compliance | High | Ensures safe and legal trading environment |

| Customer Support Availability | Medium | Helps resolve urgent trading issues |

Neglecting these factors can lead to irreversible losses and operational disruptions, affecting both confidence and profitability.

Leveraging Zoomex for a Safer and Smarter BTCUSDT Trading Experience

Zoomex offers professional-grade cryptocurrency trading designed to mitigate common pitfalls. It supports spot, contract, and copy trading with reliable liquidity and high-speed execution. Multi-signature cold and hot wallet systems enhance security, protecting user assets. Low-latency interfaces allow fast, precise order placements, crucial in volatile markets. Educational resources and real-time market insights help traders develop structured strategies. Core values like security, reliability, transparency, and user-first design directly address frequent trading mistakes, making BTCUSDT on Zoomex a safer and more strategic choice for traders at all levels.

Continuous Learning and Adaptation

The cryptocurrency market evolves rapidly, making ongoing education essential. Traders often repeat mistakes due to outdated knowledge or overconfidence. Staying informed and flexible allows adaptation to new market conditions and technological changes, reducing errors and improving profitability.

Learning Methods

Follow market updates and analytical reports to identify trends early. Study technical patterns and historical price behavior to strengthen predictive skills. Participate in demo trading or simulations to practice strategies without risking capital. Cultivating patience, discipline, and adaptability fosters consistent success and limits repeated mistakes in BTCUSDT trading.

Conclusion

Avoiding common mistakes in BTCUSDT trading requires discipline, strategy, and awareness. Ignoring trends, overleveraging, trading impulsively, neglecting volatility, succumbing to emotions, or using insecure platforms can erode both profits and confidence. Combining technical knowledge, risk management, and a clear strategy ensures more consistent results. Choosing a reliable platform with robust security, fast execution, and educational resources strengthens trading efficiency. Platforms like Zoomex provide the infrastructure, tools, and support needed for secure, fast, and professional BTCUSDT trading. Avoiding these mistakes enhances profitability, builds long-term sustainability, and prepares traders for success in the ever-changing cryptocurrency market.